Welcome to UKOM's retitled Online Market Overview* for December 2023. Using UKOM endorsed data from Ipsos iris, the OMO provides a top-line snapshot of the UK population’s online behaviour across PCs, tablets and smartphones.

Key insights this month include:

- Unsurprisingly retail dominated the list of growth categories in December. Three million more people visited brands within the greeting cards, confectionery, games and toys, and grocery sub-categories compared to September.

- M&S was the stand-out retailer in December. Its ‘12 days of M&S' promotion attracted an average of five million visitors to the app each day, compared to only 1.8m on the days when it wasn’t running. John Lewis and Argos were also popular shopping destinations online – each had an audience more than 4m higher in December than September. Of the non-high street retailers, Etsy (+3.1m) and Not on the High Street (+2.4m) added most visitors since September but Jacquie Lawson grew by a whopping 567% from 453K in September to over 3m in December – perhaps the cost of stamps has driven up the online greeting card category this year!

- The smart devices category grew by 12% - Amazon Alexa, Ring and Google Home remain the top 3 apps but Hive (+33%) and Clare Home (+69%) had higher audience growth.

- Christmas orders and deliveries drove an uplift for the shipping category (+4m) with Royal Mail (17.9m, +38%) and Evri (14.3m,+32%) being the largest in the sector.

- Since Netflix clamped down on password sharing in May, its monthly online audience has grown steadily from 16.9m to 18m in December.

- Sustainable apps have continued to attract audiences. Vinted has grown since 59% y-o-y but another one to watch is Olio – in December the food waste app had 5.7m visitors, up by 3.3m since September.

- Amazon Prime Video's audience was boosted by Premier League matches in December – the average daily audience on 5-7th (1.5m) and 26th-29th (1.3m) when Premier League games were shown was higher than on the non-football days (962k).

- After losing 66% of its monthly audience when it announced it had gone into administration, Wilko’s website has not recovered despite being purchased by The Range. In December 2023 only 1.9m visited the retailer compared to 5.4m in 2022.

- Christmas week always results in a change in people’s behaviour. On Christmas Eve, people flock to food and recipe websites – BBC Good Food always does well and this year was no exception - 2.6 million visited on Xmas Eve compared to a Dec daily average of only 1.4 million.

- Total minutes online drop by 15% on Christmas Day compared to the December daily average as less people use the internet. However, the decrease is only 6% among 18-24s.TV guides and gaming brands always attract audiences on Christmas day but even small, niche sites can benefit. For example, Backmarket had its highest December audience on Christmas Day– maybe Santa had delivered some new smartphones so people were looking to trade in their old devices?

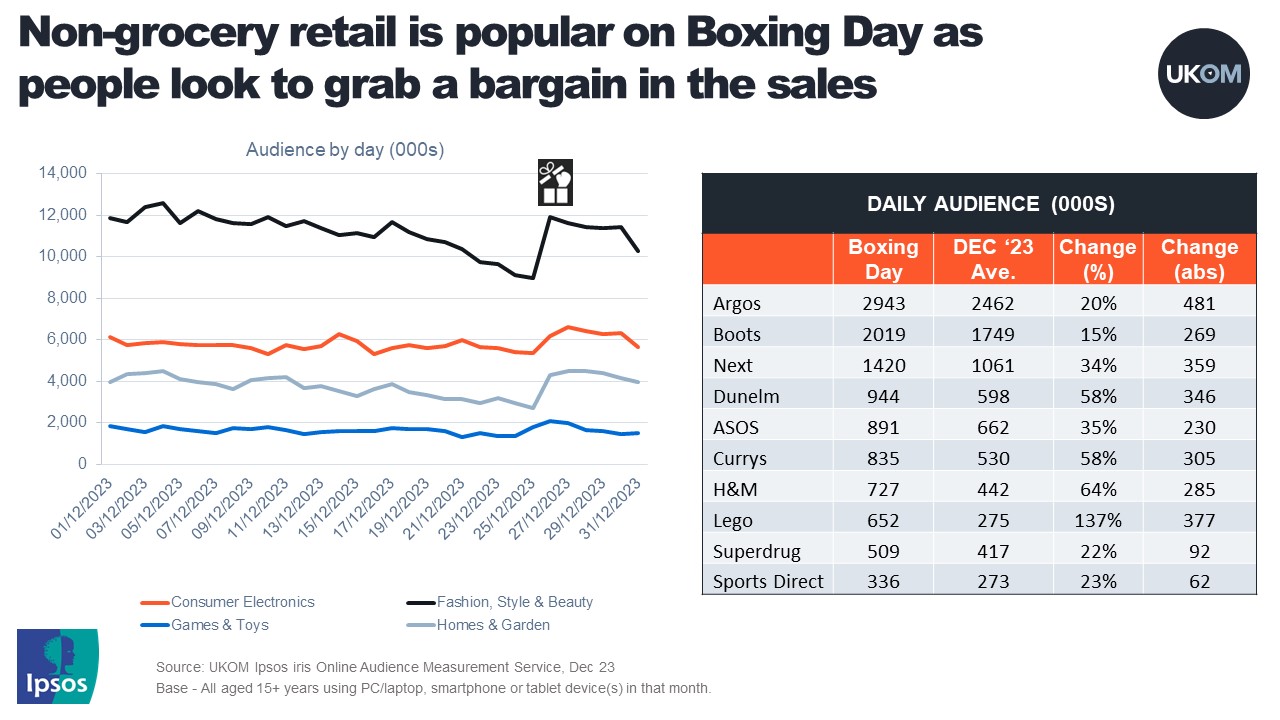

- People’s attention turns to shopping on Boxing Day. Non-grocery retail sectors such as consumer electronics, fashion and beauty and home and garden all experienced an audience boost. Argos, Boots, Next and Dunelm were just some of the big retailers who had a higher audience on Boxing Day than their daily average in December.

- Finally, January daily data revealed that in the first week of 2024 petition websites saw audiences grow – largely a result of public reaction following ITV’s Mr Bates vs. The Post Office drama series. Visitor numbers to 38 Degrees which hosted the petition to strip former CEO Paula Vennells of her CBE peaked on 5th January following the final episode’s airing the night before. The website, which was ranked 1227 on 31st December rose 1109 places to 118 on 5th January after its daily audience increased from 27K to 336K. The daily audience to Change.org was also 576K (+350%) higher on 5th January compared to the Saturday before as other petitions related to the scandal attracted interest.

You can find more information on Ipsos iris here

*These were previously Digital Market Overviews but our name contains "online" so we've finally dropped "digital" and picked online as a much better synonym for the internet.