Welcome to UKOM's Online Market Overview for March 2025. Using UKOM endorsed data from Ipsos iris, the OMO provides a top-line snapshot of the UK population’s online behaviour across computers, tablets and smartphones.

Key insights this month include:

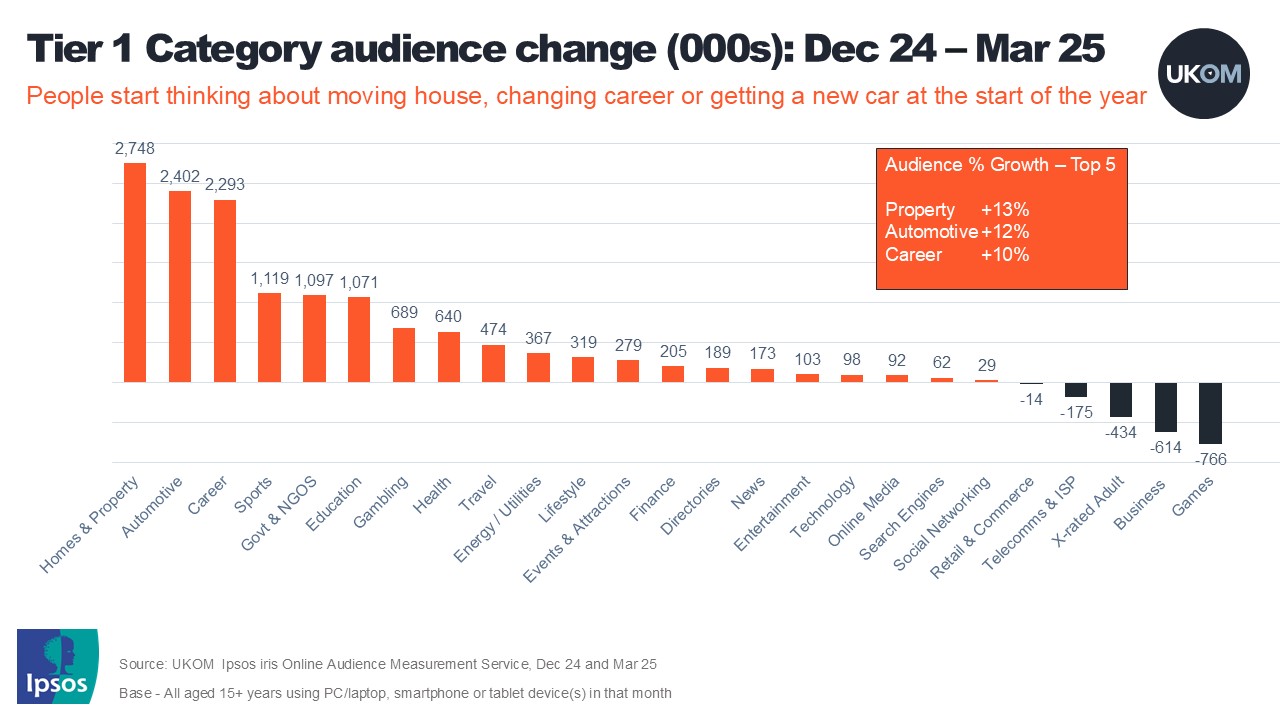

- Categories adding audience between December and March include Homes and Property (+13%), automotive (+12%) and careers (+10%) as people turn their attention to job, house and car searches. Sport also attracted audience with Rugby and motorsport being the main drivers due to the Six Nations and start of the F1 season.

- Unsurprisingly given category performance, Rightmove, Zoopla and OnTheMarket all featured in the top 20 brands for most audience added between December and March along with LinkedIn and Indeed.

- Other brands experiencing strong gains in March included Gov.uk and HMRC as the tax year came to an end while travel brands including Booking.com, Airbnb and Tripadvisor all attracted audience as people started thinking about holidays.

- After dipping slightly in December, Temu’s audience surpassed 25m in March, making it bigger than Tesco and Argos. Half (49.8%) the population now use the Chinese discount retailer. Unsurprisingly, April top-line daily data shows M&S’s daily online audience started to decrease at the end of the month due to the cyber-attack.

- Deliveroo made the news this week after agreeing terms for a £2.9bn sale. 6.8m visited the food delivery service in the UK in March, behind Just Eat (11.7m) and Uber Eats (9.6m)

- After strong growth following the US Election, Bluesky’s audience has plateaued since December – with just over 3m using the service each month. X may be declining but over 21m used its website or app in March while 8.6m used Threads.

- IKEA opened a new flagship store in London last week – latest data shows that IKEA is the biggest online home retail brand for Londoners – just over 1m visited IKEA online in March, with B&Q and Dunelm the next most popular.

For more information on the UK online market including the top online brands and apps and how usage varies by audience and device, please read or download the whole report below.

More information on Ipsos iris here.