Welcome to UKOM's Online Market Overview for December 2025. Using UKOM endorsed data from Ipsos iris, the OMO provides a top-line snapshot of the UK population’s online behaviour across computers, tablets and smartphones.

Key insights this month include:

- Retail unsurprisingly dominated the the list of growth categories in December, with games and toys, snacks and confectionery, greeting cards, and fashion and beauty all seeing the largest audience gains since September.

- Retailers also led the list of brands adding the most audience Sep-Dec, with Argos, M&S, John Lewis, Boots and Sainsbury’s each growing their audiences by more than 3m.

- Christmas orders and deliveries drove an audience uplift for the shipping category (+4.6m) with Royal Mail (+4.6m) and EVRi (+2.8m) being the main drivers of growth. Games (+2.4m) and gambling (+1.9m) categories also grew.

- The purposeful AI technology category continued its upward trajectory, adding 2.3m users Sep-Dec. 17.5m people used the market leader, ChatGPT, in December - some way ahead of Grok (693k) despite the latter dominating the headlines.

- MTV closed its music channels on 31st Dec, with a shift towards online music video consumption on platforms like YouTube contributing to its demise. Ipsos iris data shows that the top five largest YouTube content owners by audience in December were all music companies - Universal, Warner, Sony, Haawk and Vevo.

- The BBC recently announced a partnership to create original content for YouTube in a bid to reach younger audiences. In December, 23% of viewers of current BBC content on YouTube were aged 15-24 compared with just 9% of those using the BBC iPlayer app on tablets and smartphones.

- In daily usage trends, Spotify’s audience peaked at 12.3m on 3rd Dec when it exceeded the monthly average by more than 2.5m users due to the launch of Spotify Wrapped.

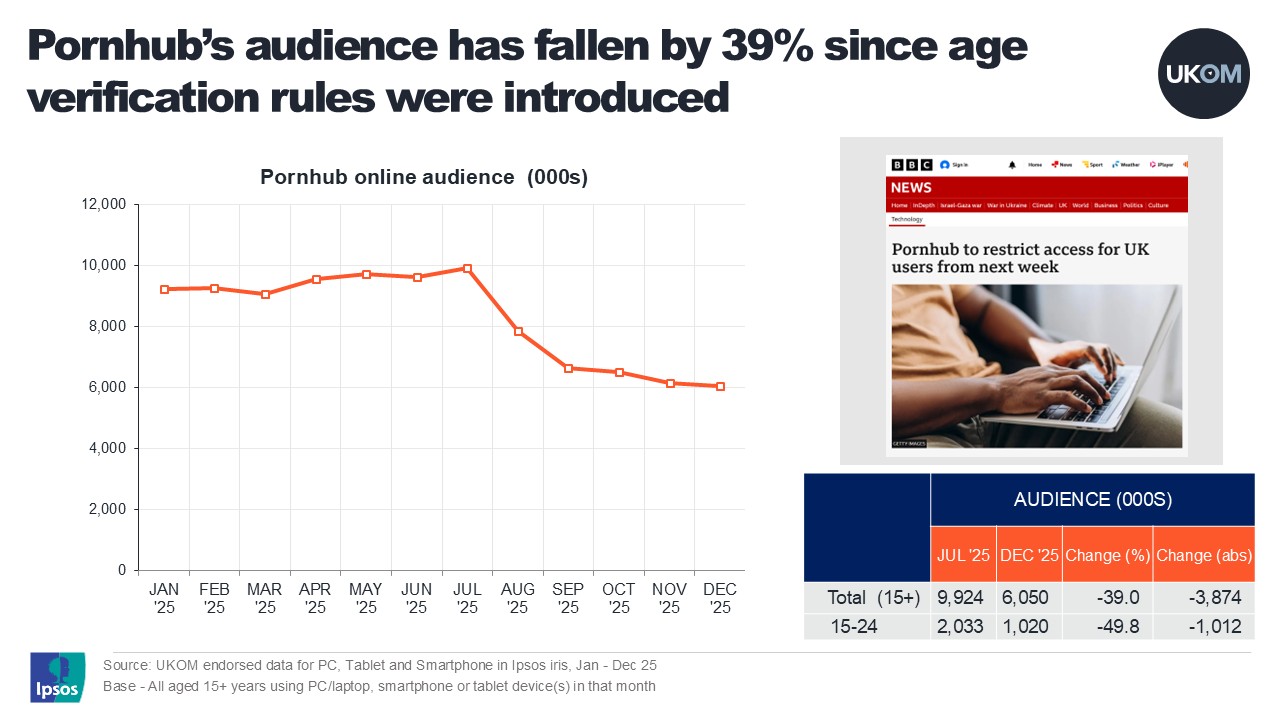

- Finally, as Pornhub announces new UK users will be blocked from accessing the service from 2nd Feb, Ipsos iris data shows its audience had already declined by 39% since the introduction of age verification rules in July with the fall steepest among 15-24s (-50%).

For more information on the UK online market including the top online brands and apps and how usage varies by audience and device, please read or download the whole report below.

More information on Ipsos iris here.