The growth of Chinese brands Temu and Shein alongside the popularity of the resale platform Vinted has intensified the pressures on an already-challenged UK high street.

As consumers increasingly gravitate towards these international platforms that pair product variety with aggressive pricing, domestic brands are under mounting pressure to differentiate through experience, service, and value propositions rather than scale alone.

UKOM-endorsed Ipsos iris data covering PCs, tablets and smartphones provides daily reporting that helps retailers stay on top of the evolving online retail landscape. By measuring the entire category, it enables early identification of competitor threats, emerging consumer trends, audience profiles and cross-usage behaviours, supporting more informed business decisions.

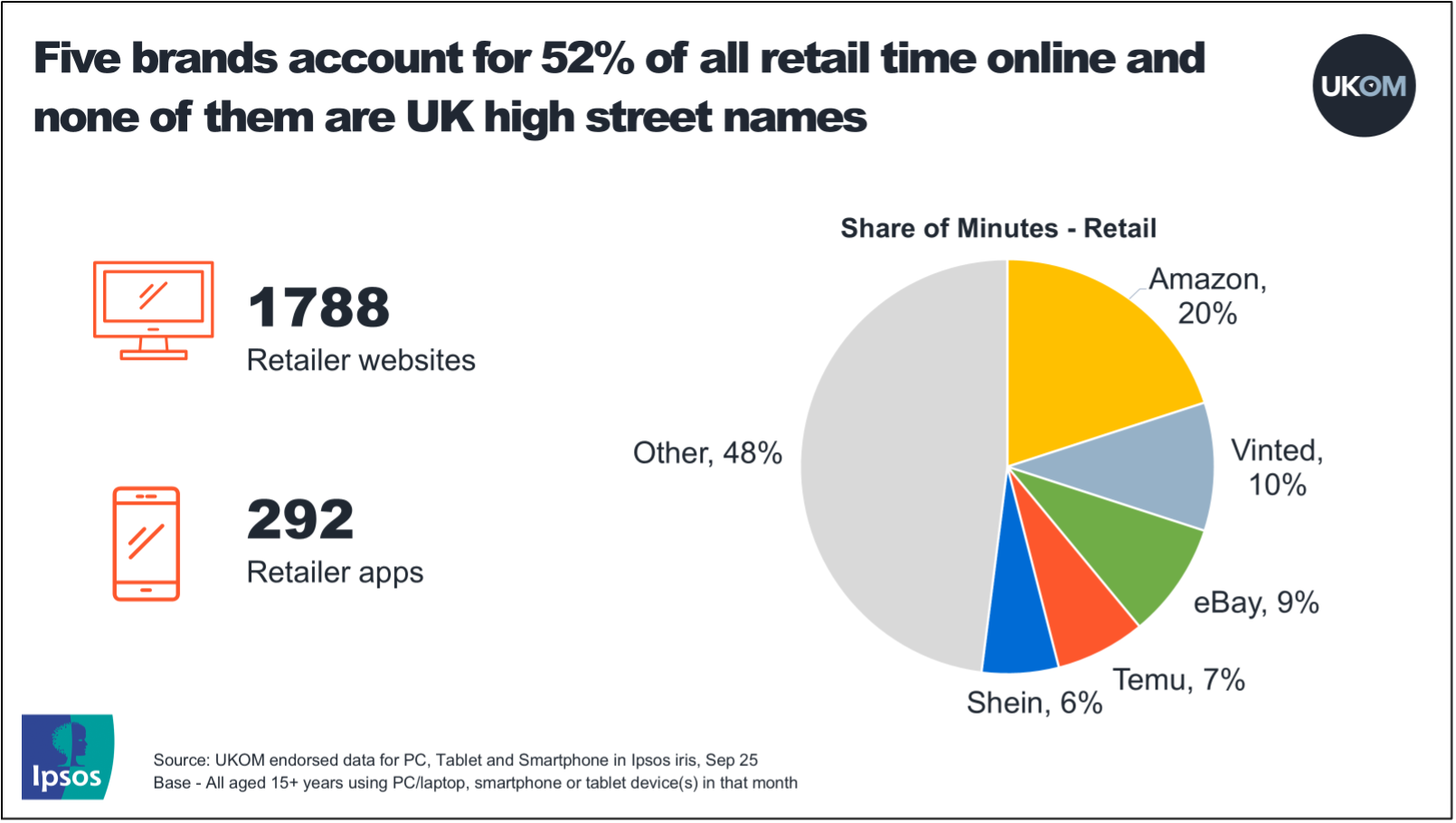

Here's some highlights from our look at the sector – all drawn from UKOM-approved data in Ipsos Iris reporting usage of nearly 2,000 retail websites and 300 apps every month.

- Despite huge fragmentation, excluding platforms like TikTok, just five brands now account for 52% of all retail time spent online. Notably, none of them are British, and none maintain a physical presence on the UK high street. While Amazon has dominated online time spent for many years, recently the Chinese players Temu and Shein have established themselves in the top five. Latest data shows that Temu, which only launched in the UK in 2023, now has a monthly audience of over 30m, while Shein’s audience has grown from 9m to 16m over the last 2 years – its highly engaged audience driving significant minutes.

- In addition to competing with global online players, high street retailers are also feeling the impact of growing peer-to-peer (P2P) commerce. While eBay has long held a top-two position for time spent, recent attention has shifted toward Vinted. eBay still reaches more users (62% vs 30%), but Vinted’s engagement levels have surged, with users now spending an average of 164 minutes on the platform each month. UKOM-endorsed Iris data shows that in August the Lithuanian pre-loved clothing marketplace overtook eBay in total minutes and now accounts for one in ten retail category minutes spent online by the UK internet population.

- Vinted is also popular for cost-conscious shoppers looking for a good deal, however, unlike the Chinese brands, Vinted’s focus on sustainability also appeals to younger socially responsible individuals.

As well as passively collecting online usage data online, Ipsos iris asks a series of lifestyle statements to the UK online population.

For example, while 45% of Vinted’s audience agreed with the statement “I would be prepared to pay more for environmentally friendly products,” 80% of them had visited Shein or Temu in the last month.

This disconnect between stated eco-conscious intentions and actual purchasing behaviour also shows the benefit of UKOM’s passively collected internet behaviour measurement approach. Maybe these shoppers aren’t quite as eco-friendly as they claim?

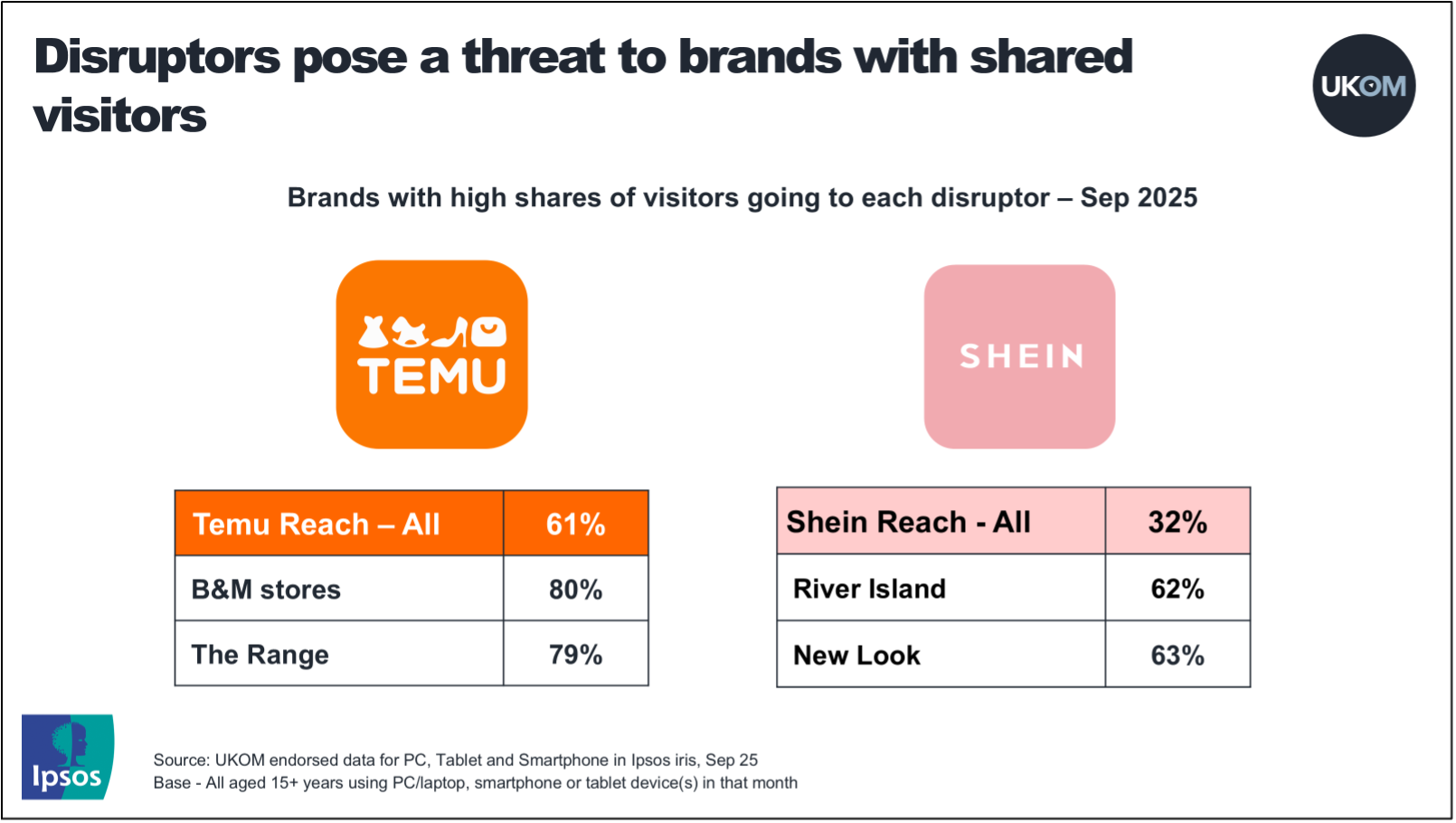

- Given the growth of Temu, Shein and Vinted, it’s no surprise that 2025 has seen multiple high street names report financial difficulties. Audience overlap analysis in Ipsos iris can help retailers identify possible online competitor threats if shared visitation with these disrupter platforms is high.

For instance, while 61% of the UK internet population use Temu, this rises significantly to 79-80% among visitors to B&M and The Range online. Likewise, Shein’s reach is far higher among people who visit fashion retailers New Look and River Island online (62-63%) compared with the overall UK internet population (32%). Although Ipsos iris does not yet report specifically on TikTok Shop, the platform’s growing influence is evident, with 57% of the online population now using TikTok, further shaping dynamics within the retail sector.