Welcome to UKOM's Online Market Overview for September 2024. Using UKOM endorsed data from Ipsos iris, the OMO provides a top-line snapshot of the UK population’s online behaviour across computers, tablets and smartphones.

Key insights this month include:

- After a bumper month for Politics and Football in June with the General Election looming and the Euro’s, audiences for both categories were nearly 5 million lower in September. Boxing was September’s sport success story driven by interest in the Joshua v Dubois fight on 21st September. On the 22nd 1.8m visited the category compared to a typical average daily audience of 142k.

- Audience to AI services like Chat GPT continue to grow. Nearly a quarter (24%) of the UK online population now visit the category monthly and although this is still very skewed towards students in full-time education (39%), reach is also higher among people with learning disabilities (34%) and those seeking work (34%).

- Oasis & Coldplay drove people to ticketing websites in August and September with Ticketmaster’s daily audience surpassing 3m on 31st August.

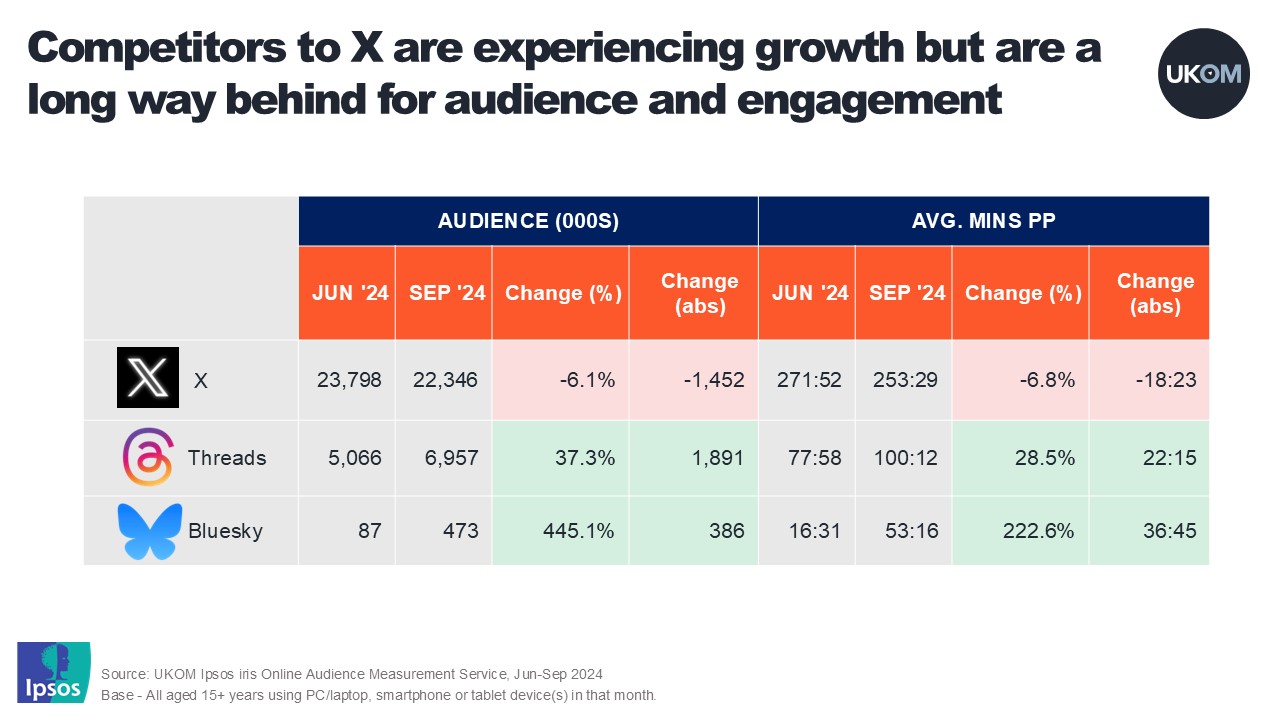

- After peaking in July, the audience of X has declined in recent months. In September 22.3m people used the service, a decrease of 1.5m (-6%) compared to June. Although still some way behind X, Threads (up by 37% to 7m) and BlueSky (up by 445% to 0.5m) both grew over the same period.

- Temu’s audience grew by 12% Jun-Sep with growth highest among 15-24s (29%) while Vinted’s popularity continued – the pre-loved retailer’s audience was 1m higher in Sept than June.

- Topline daily October data indicates a boost for the BBC News app and X on the day that Liam Payne’s tragic death was announced on 16th, whilst the BBC weather app attracted 3.8m people on 10th when it forecast hurricanes in error - over 1m more than the Thursday before. Unsurprisingly, given the budget there was also an increase in time spent on apps from BBC News (+43%) and Sky News (+26%) on October 30th compared to the day before!

For more information on the UK online market including the top online brands and apps and how usage varies by audience and device, please read or download the whole report below.

More information on Ipsos iris here.