Welcome to UKOM's Online Market Overview for September 2025. Using UKOM endorsed data from Ipsos iris, the OMO provides a top-line snapshot of the UK population’s online behaviour across computers, tablets and smartphones.

Key insights this month include:

- Following the introduction of new age-verification rules, the ‘Adult’ category audience declined by 2.3m (-14%) since June, with the steepest drop among 15–24-year-olds (-20%). Market leader Pornhub saw its audience fall from 9.6m to 6.6m.

- Other declining categories included Homes & Property (-1.5m) and Gambling (-1.2m).

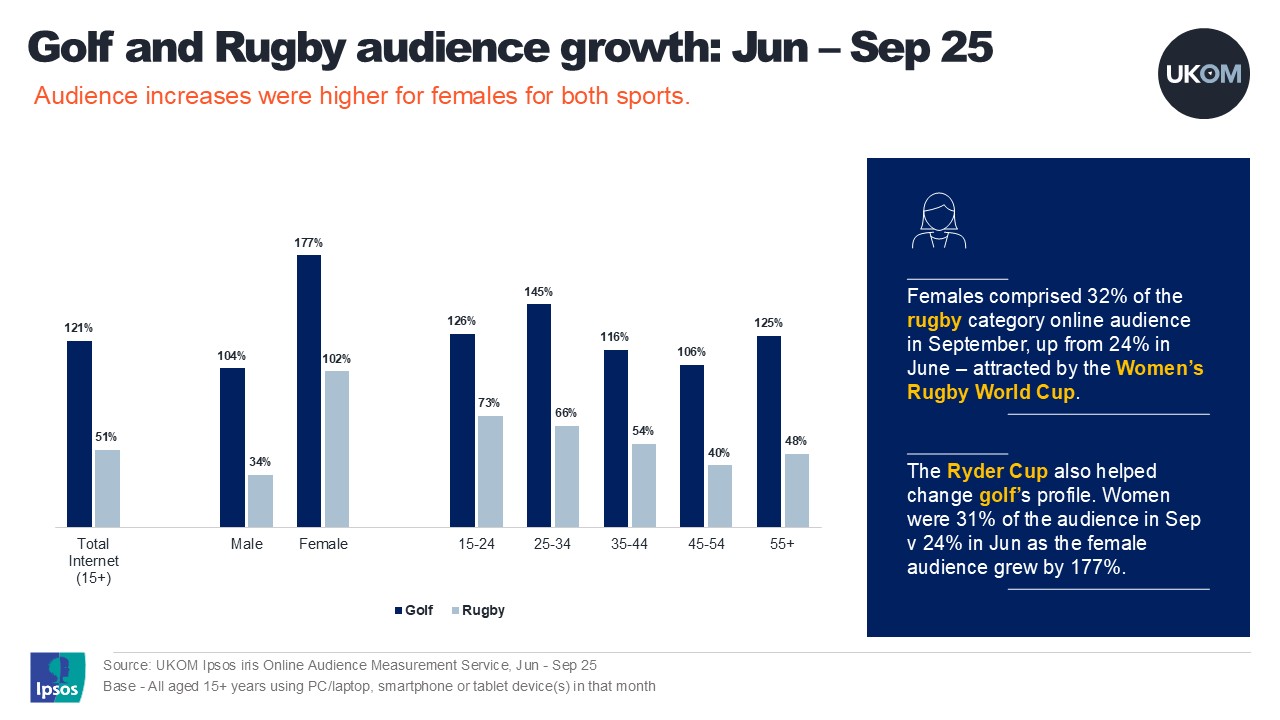

- The Sport category saw growth in both reach and engagement between June and September. Golf’s audience more than doubled from 3.1m to 6.9m (+121%), boosted by the Ryder Cup at the end of September. The Rugby category audience grew 51%, fuelled by females (+102%) following England’s success in the Women’s World Cup.

- The start of the Premier League reignited football interest, with average time per person per month up from 26 to 49 minutes. The Premier League’s mobile app audience rose by 1.5m (Jun–Sep), while both audience and time spent viewing Sky Sports content on YouTube increased by over 60%.

- Five global, online-only brands — Amazon, Vinted, eBay, Temu, and Shein — now account for 52% of all retail time online. After a decline from March to June, M&S rebounded to pre–cyber attack levels, with its audience up 2m (Jun–Sep) and total minutes up 124%.

- Ryanair experienced a strong summer versus last year, narrowing its online audience gap with EasyJet. However, its planned introduction of mandatory digital boarding passes may disadvantage some groups — notably the 7.1m people who do not use smartphones to go online, with reach among those aged 75+ at just 52.6%.

- On 20 October, widespread AWS service disruptions led to declines in app engagement across several major platforms including Snap, Instagram, Reddit, Duolingo, and Strava, all of which saw daily minutes drop.

For more information on the UK online market including the top online brands and apps and how usage varies by audience and device, please read or download the whole report below.

More information on Ipsos iris here.